Keeping track of your bank balance is an important part of maintaining your financial health, as is tracking your income and expenses.

If you’re an FAB bank customer, you may know that the bank offers various services to help you manage your finances, including a bank balance check using your Ratibi FAB card.

FAB Balance Check 2026

In this blog post, we will look at how to use the FAB bank balance check in the 2026 facility to stay on top of your finances. We’ll share different ways you can access this information, the features and benefits of doing so and its importance.

What Is FAB Bank Balance Check?

Table of Contents

- 1 FAB Balance Check 2026

- 2 What Is FAB Bank Balance Check?

- 3 FAB Bank Balance Check – Step-By-Step Guide

- 3.1 Method 1. Using FAB Bank Website

- 3.2 Method 2. Using FAB Bank Mobile App

- 3.3 Method 3. Using FAB Bank ATM

- 3.4 FAB Bank Salary Account Balance Check

- 3.5 How To Open FAB Bank Account?

- 3.6 How To Activate FAB Mobile Banking?

- 3.7 What Is The Minimum Balance In FAB Account?

- 3.8 What Is FAB Swift Code?

- 3.9 FAB Customer Care Number

- 3.10 Advantages Of Using The FAB Balance Check Service

- 4 FAQs

FAB bank balance check is an online facility provided by FAB Bank that allows customers to view their account balances and past transactions. It is a simple and convenient way to track the money coming into and out of your account.

The bank balance check service provides customers with real-time updates on their account balance and transactions, making it easier to manage their finances.

For those who receive a salary in their bank account, it is beneficial to use the FAB bank balance check facility to confirm that the funds have been deposited.

FAB Bank Balance Check – Step-By-Step Guide

There are three of the most popular and easiest ways to check your FAB Bank Balance. One is through the FAB bank website, another is via the FAB mobile banking app, and the third is by visiting a FAB ATM.

Here’s a step-by-step guide to each of these methods:

Method 1. Using FAB Bank Website

If you don’t want to install the mobile app, you can check your balance by using FAB Bank’s online banking service.

Step 1: To do this, visit the FAB website and go to the card service page (Link given below). You’ll see two empty boxes, which you have to fill and log in to your account.

Step 2: Enter the last two digits of your FAB card in the first empty box.

Step 3: Once you are done, fill in the second box with the 16-digit Card ID. You can easily find it on your FAb card on the bottom front side.

Step 4: After entering all the details, click on the ‘Login‘ button.

Step 5: You’ll be redirected to your account page. Here you can check the total balance of your FAB bank account in real time.

Method 2. Using FAB Bank Mobile App

If you need to check your bank balance regularly, it’s recommended that you download the FAB Bank Mobile app. It’s available on the iOS and Android app stores.

Step 1: Download the FAB Bank mobile app from your device’s app store. Here are the app download links for the APP STORE (For iOS) and the PLAY STORE (For Android).

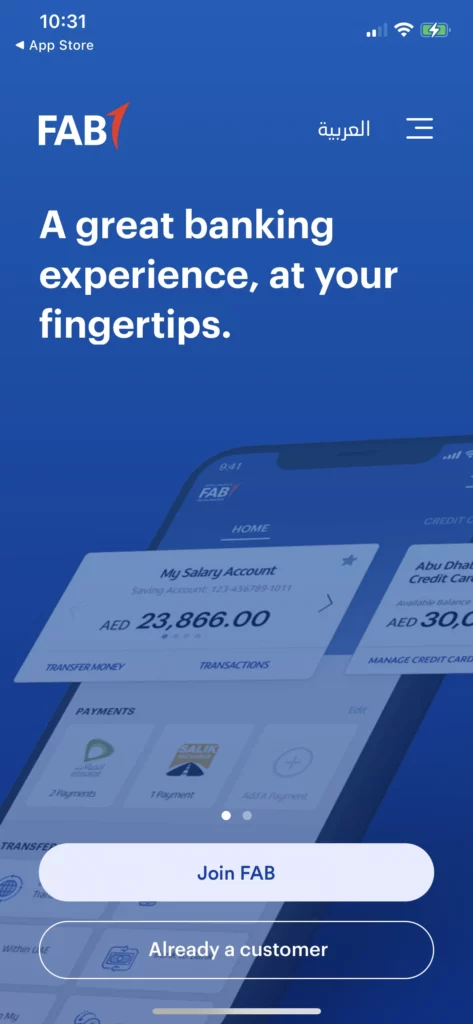

Step 2: After installing the app, open it on your device and log in with your credentials. If you’re using it for the first time, you’ll need to enter your customer ID or debit card number, then split the password sent to your registered mobile number or email address, and generate a 6-digit PIN for future logins.

Step 3: Once logged in, you can view your account balance on the homepage.

Step 4: You can also view your past transactions and other details on the app.

Method 3. Using FAB Bank ATM

If you don’t have access to the internet or mobile phones and are looking for an offline method to check your bank balance, you can use the FAB Bank ATM.

Step 1: Visit the nearest FAB Bank ATM and insert your FAB Bank debit card.

Step 2: You’ll see several options, such as withdrawal and deposit. Choose the “Check Balance” option.

Step 3: You’ll be asked to enter your ATM PIN. Enter it, and your bank balance will appear on the screen.

FAB Bank Salary Account Balance Check

Do you own a FAB bank salary account? No worries; the process for checking your bank balance is the same as mentioned above.

FAB Bank offers a separate account to those who are paid a salary. This is just to give you easy access to manage your salary and other financial activities. Otherwise, the process of checking the FAB bank balance remains the same for all FAB bank accounts.

You can use any of the methods above, but the easiest is through their official website.

The FAB bank provides a prepaid card to every customer with a salary account, making it easier to withdraw funds or transfer money to other bank accounts. You can also use the prepaid card to make online purchases, shop at stores, and access various services.

With these card details, such as the last two digits of the card and the 16-digit Card ID number, you can easily access your account and check your salary balance online.

How To Open FAB Bank Account?

If you are looking to open a FAB bank account, there are several types of accounts, such as salary, savings, and current accounts.

To open a bank account with FAB Bank, you have four options:

- Visit your nearest FAB Bank branch, fill out the required forms, and submit them with the necessary documents

- Fill out the online application form on the FAB Bank website.

- Download the FAB Bank mobile app, fill in your details, and submit them online to open your account.

- Call FAB Bank customer service and complete the application over the phone.

To open a bank account with FAB Bank, you must verify your mobile number and provide the necessary documents, such as proof of identity and address.

Once your account is open and activated, you’ll receive a FAB Bank debit card, which you can use to check your balance, withdraw money from an ATM, shop online, and make payments.

How To Activate FAB Mobile Banking?

To activate FAB Mobile Banking, you need to have a valid FAB Bank debit card. If you have it, then you need to follow the steps below:

Step 1: Download the FAB Bank mobile app from your device’s app store. It’s available on both iOS and Android.

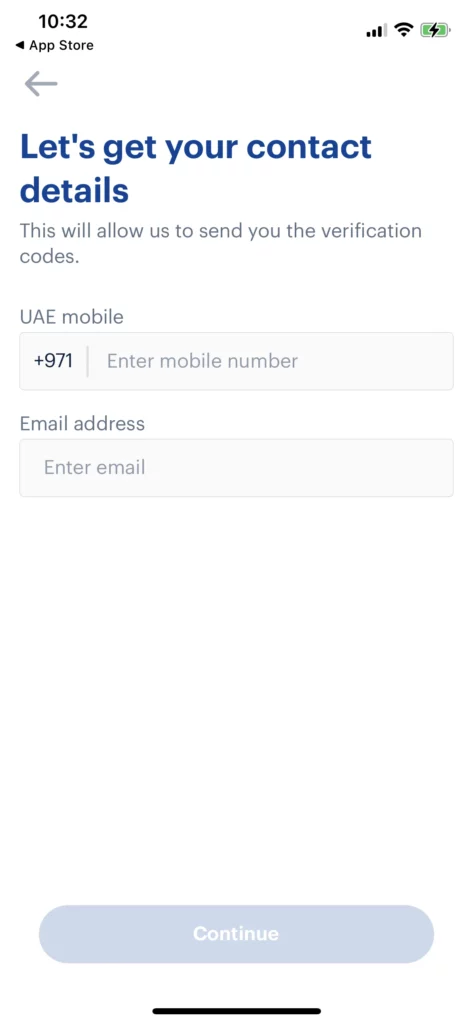

Step 2: Open the app and register for mobile banking.

Step 3: You’ll need to provide your debit card details and OTP number sent to your registered mobile phone or email address.

Step 4: Create a new login password by following the on-screen instructions.

Once you’ve completed the registration process, you can use the FAB Bank app to check your balance, transfer money, and pay bills.

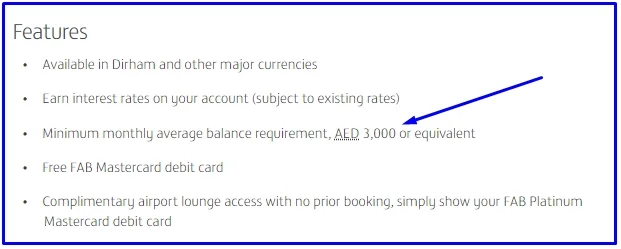

What Is The Minimum Balance In FAB Account?

There is no minimum balance requirement to maintain a FAB Bank account. However, if you have a personal savings account with FAB Bank, you must maintain a minimum balance of 3000 AED.

If your account balance goes below 3000 AED, you’ll be charged a penalty of 10 AED per month.

If you’re just using a FAB Bank account for cash deposits and withdrawals, you don’t need to worry about the minimum balance. This is because the account you own in this situation is an Elite savings account by default, which doesn’t require you to maintain any minimum balance.

What Is FAB Swift Code?

FAB Bank’s SWIFT code is NBADAEAAXXX. SWIFT stands for Society for Worldwide Interbank Financial Telecommunication, a global organisation that provides secure and reliable financial transaction services.

The code identifies the bank branch to which the money needs to be transferred. Each bank has its own unique SWIFT code that is used for both domestic and international money transfers.

You must provide the SWIFT code for the bank branch involved in each transaction whenever you send or receive money.

FAB Customer Care Number

If you have any questions regarding FAB Bank services, you can contact their customer care team by calling 600525500 or visiting their website.

However, this number is valid only for UAE residents. If you’re from abroad, you can call them at +971 2 6811511.

You can also contact them on social media, including Facebook, Twitter, Instagram, and LinkedIn. Their social media profiles are on their website.

Advantages Of Using The FAB Balance Check Service

The FAB Balance Check service is a great way to monitor your bank account and manage your finances. It provides real-time information about your balance so you can plan and budget accordingly.

The service is also very secure, using strong encryption technology to protect your information from unauthorised access and theft. Additionally, the service offers several ways to check your balance, including online platforms and mobile banking.

You can always check if your salary has been credited to your account, if any deductions have been made, and when a transaction has been successfully completed.

Overall, the FAB Balance Check service offers a convenient and secure way to monitor your bank balance and ensure your money is used responsibly.

FAQs

Q. What is the minimum balance in FAB bank?

Answer: There is no minimum balance requirement in the FAB bank if you own a by default provided savings account. However, if you have a personal savings account with FAB Bank, you must maintain a minimum balance of 3000 AED.

Q. What is the blocked amount in FAB?

Answer: Block amount is the term used when your bank holds a part of your balance for a specific period. This usually happens when you make a transaction, such as an ATM withdrawal or a purchase with your debit or credit card. This amount will be held until the transaction is processed.

Q. How do I check my FAB bank statement?

Answer: You can check your FAB bank statement online by logging in to your account or requesting a physical copy of the statement from the FAB bank. You can also check your statement through the mobile banking app.

Conclusion

The FAB bank Balance Check service is a great way to keep track of your money and ensure it is used responsibly.

With its secure encryption technology and a variety of ways to check your balance, FAB Bank has made it easy to stay up-to-date with your finances.

If you have any questions about checking your balance in FAB Bank, feel free to contact the customer service team or contact us.

- How To Get FAB Bank Statement Online? - April 10, 2023

- How To Open FAB Bank Account? - March 28, 2023